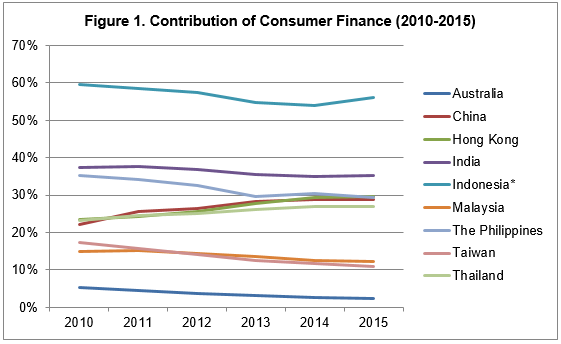

The contribution of consumer finance to the overall retail loans in Asia Pacific in 2015 ranged from 2% to 56%. Its share to retail loans has increased in markets like Indonesia but has declined in Hong Kong and Thailand. The growth of consumer finance per country also varied, slowing down in Taiwan and growing faster in the Philippines.

May 09, 2016 | Wendy WengIn the Asia Pacific region, the consumer finance business varies widely across countries. Among the markets covered in this report, the contribution of consumer finance to total retail lending ranges from 2% to 56% (Figure 1). In Indonesia, consumer finance stood at 56% of their total retail loan portfolio in 2015, which is considerably higher than the consumer finance portfolio of other markets. India held the second-largest share of consumer finance at 35%. The 2% share of consumer finance in total retail loans in Australia was lowest among these markets, followed by Taiwan (11%) and Malaysia (12%). The share of consumer finance in other markets is around 30%.

The contribution of consumer finance to total retail lending ranges differ among Asia Pacific countries

Source: The Asian Banker Research

The above data is available in full to RBWG members. For access, go to http://retailbanking.theasianbanker.com

Consumer finance evolves at different speeds in the region. During the past five years, consumer finance has slowed in Australia and Taiwan. Its growth decelerated in some markets, such as China, Malaysia, and Thailand. However, some markets also experienced faster growth, such as India and the Philippines.

Hong Kong

Consumer finance in Hong Kong experienced a 14% compound annual growth rate (CAGR) between 2010 and 2015, supported by the existing low-interest-rate environment (Figure 2). During 2010–2015, credit card loans and other personal loans registered a CAGR of 8% and 17%, respectively. Credit card loan growth slowed to 3% CAGR between 2013 and 2015, while other personal loans for private use had flat growth during the same period, mainly because banks enhanced their loan portfolios and improved flex...

Categories:

Asia Pacific, Consumer Finance, Credit Cards, Hong Kong, Indonesia, Mortgage, Philippines, Retail Banking, Taiwan, ThailandKeywords:Asia Pacific, Consumer Finance, Retail Loans, Hong Kong, Indonesia, Philippines, Taiwan, Thailand, CAGR, Credit Cards, Mortgages, NPL