Indian banks’ non-performing loan ratio grew to 3.1% in FY 2012, posing an increased threat to bank liquidity and profitability levels.

June 14, 2013 | Wendy WengIndian banks deteriorating asset quality, as evidenced by a steady increase in non-performing loans (NPL) in recent times, can be attributed to the country’s economic slowdown and high interest rates over the past few years. Also, inadequate credit appraisal (from 2003 to 2007) of banks has also contributed to a rising NPL ratio – as it increased to 3.1% in FY 2012 from 2.25% in FY 2011.

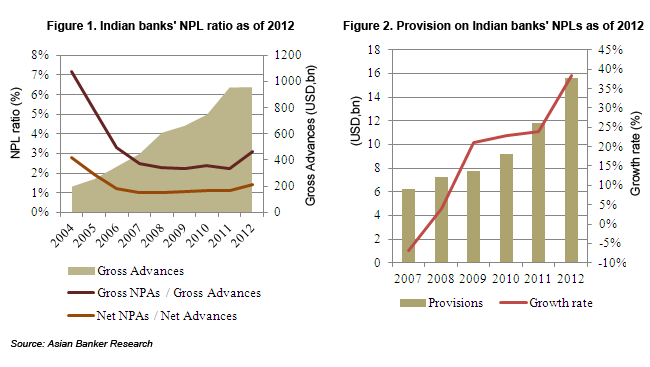

Total bank loans in India amounted to $958 billion as of March 2012, growing at a CAGR of 22.6% during the FY 2004 - FY 2012 period. Due to prudential and recovery management measures adopted by Reserve Bank of India (RBI), banks’ gross NPLs decreased at a CAGR of 8% from FY 2004 - FY 2007. However, following 2007, banks’ gross NPLs begun to grow at a CAGR of 23%. As of FY 2012, banks’ gross NPLs grew 45.3% to $29.7 billion.

On another note, Indian banks’ net NPL ratio grew slower than the gross NPL ratio, which can be attributed to the higher provisions that have been made. Provisions for NPL grew 38.3% to $15.6 billion in FY 2012, compared to 23.8% in FY 2011.

Indian banks NPL ratio rose to 3.1% in FY 2012

Given the fact that Indian banks have significantly restructured their loans (more than once), the actual NPL ratio might be greater than reported by official figures. In a bid to control high NPLs, RBI has allowed banks to restructure their loans by reducing interest rates and extending the repayment period. As a result, while the subsequent NPL ratio appeared to have decreased, banks’ restructured loans have increased considerably. Indian banks’ loans rose at a CAGR of 42.54% over the past three years to $45.5 billion, or 4.68% of NPLs in FY 2012. 15-25% of banks’ restructured loans are said to have fa...

Categories:

Databook, India, Regulation, Risk and RegulationKeywords:NPL, Restructured Loans, RBI, Credit Risk, Liquidity Risk