2016 saw a rapid progress in disruptive technologies bringing a paradigm shift in the thought process of institutions towards technology adoption and transformation. What will be the top technology priorities and trends in the banking industry in 2017?

April 10, 2017 | Neeti Aggarwal- Digital and mobile experience, data analytics and cybersecurity preparedness are some of the top technology investment priorities of leading banks in Asia Pacific

- Removing any issues or friction from customer journey in the financial processes will remain the most important technology focus in 2017

- Other leading trends include partnership with fintechs, insuretech, regtech, open API and blockchain

New technology innovations and shifting competitive landscape due to the entry of fintech start-ups, payment players and challenger banks will change how transactions will be carried out in the future. Furthermore, new players unbundled banking services by providing innovative services to individual segments, removing existing inefficiencies in the processes. All of these changes are forcing banks to relook at their technology capabilities and operating and service delivery models to retain wallet share.

While technology transformation is inevitable (and will probably be rapid), few areas emerge as distinct priorities of financial institutions and hot trends for 2017.

Technology priorities of banks in 2017

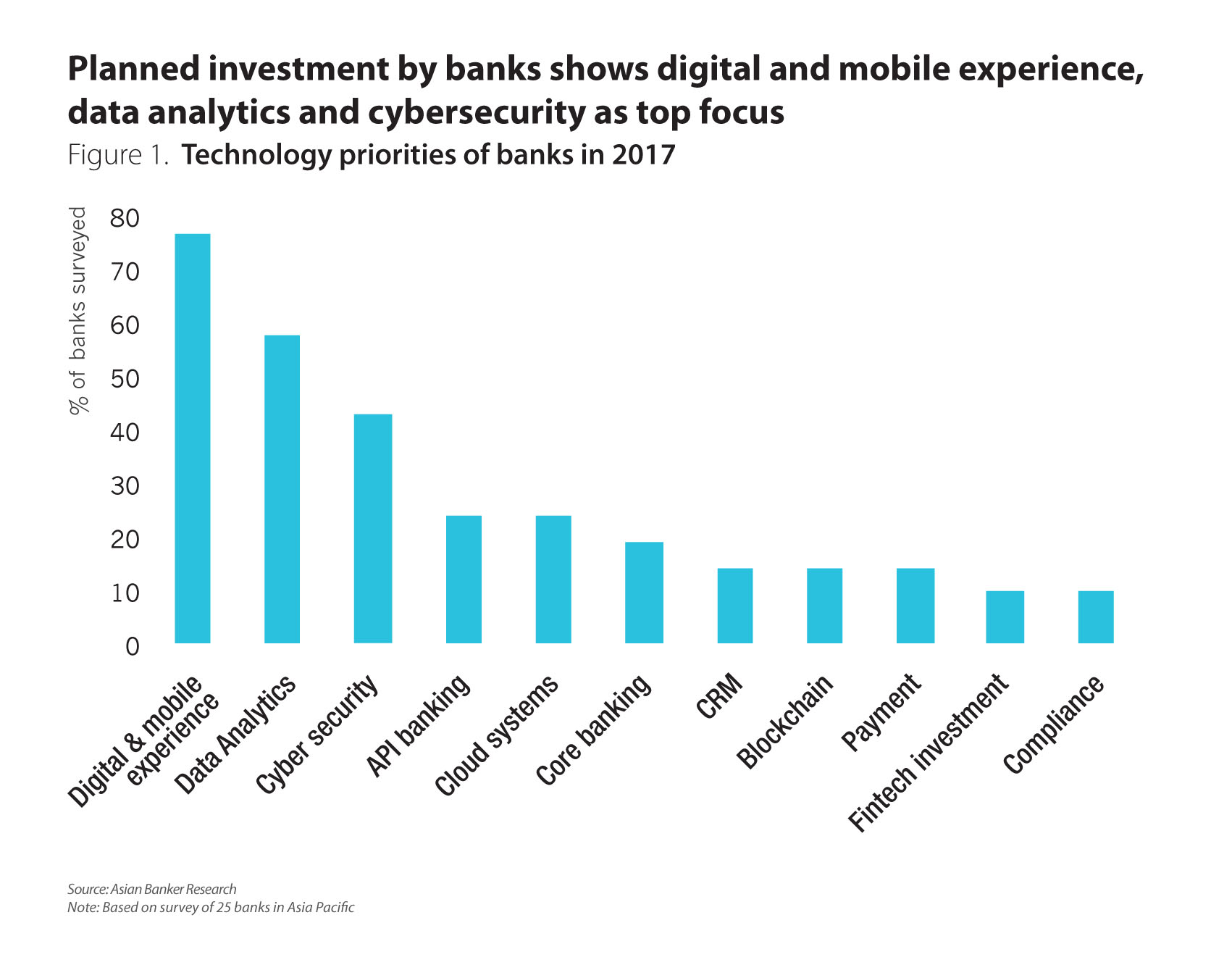

A survey across some of the leading banks in Asia Pacific on their key priorities in technology investment in 2017 highlights following focus areas (Figure 1).

Improving mobile and digital experience remains a key priority for financial institutions in 2017. While a rich mobile banking system is an industry standard today, best banks aim to differentiate their digital experience with unique lifestyle and personalised features and improved user interface and mobile payment services such as near field communication and contactless payments. There is also an increasing convergence of messaging apps and the integration of micropayments.

Another top priority among banks is strengthening their data and analytics capability as the universe of digital information grow exponentially, bringing new opportunities for improved actionable customer insights, especially from big data.

Moreover, threats on cybersecurity remain one of the top priorities among banks. It is also the biggest challenge faced by most bankers as online attacks become increasingly sophisticated and rampant with ingenious fraudsters managing to stay a step ahead despite various security measures. Other key priorities include cloud computing, open API banking, investments into fintech, and emerging areas of blockchain.

Top technology trends in 2017

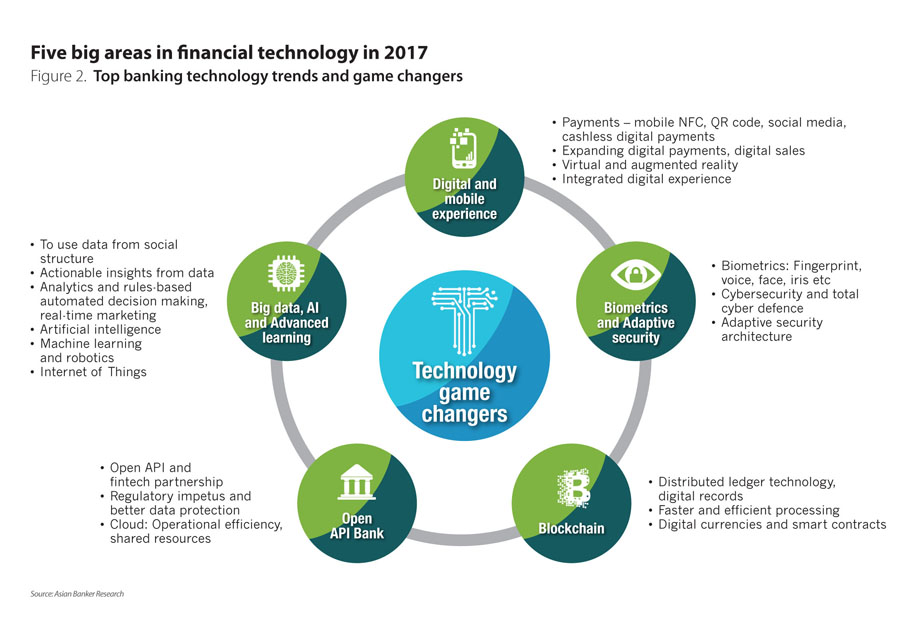

During a recent The Asian Banker (TAB) Live session, Chris Skinner, author and fintech commentator, theFinanser.com, and TAB's research team shared their views on the top trends in banking technology in 2017 (Figure 2).

Top areas in financial technology that will continue to remain focus

Removing the friction: Customer experience will remain utmost priority for banks. “This year will focus on taking away all the issues in customer journey when they use financial services as in removing any friction in processes that involve paperworks and customer pain," noted Skinner. He shared example of fintech startup like Stripe that allows merchant check out that a small business can set up within minutes.

Insuretech and regtech: Insurtech, which has witnessed a wave of fintech start-ups entering the insurance industry; and regulatory technology (regtech), which provides analytics to banks’ trade and services in real time, were among the top trends highlighted by Skinner.

Digital and mobile experience: As banks compete with new agile entrants that are readily adaptive to new technologies and not encumbered by the legacy baggage, they will need to focus on bringing holistic digitisation. New innovations will be seen in mobile banking services as banks move towards a "digital first" strategy, providing and building services using smartphone as the focal point. There will be increased integration of social media services with mobile apps, wallet and bank services. Mobile technology is changing the game for financial inclusion and the disruption from emerging markets could be taken into the developed markets such as mobile wallets.

“It is all about the banks being built for physical distribution and paper in proprietary structure, and focused on building and humans, and having to convert to the digital distribution of data, which is built on an open market and focused on software and service. This is a big change not only in structure but also in the culture. In five to ten years, if a bank does not covert to a digital structure, it will start to fail. They have to be open to partnering with external players, which requires a different thinking in the boardroom,” pointed Skinner.

Open API: New fintech start-ups are coming up with innovative solutions such as simple APIs to improve customer journeys. With open API, banks can plug and play into the digital ecosystem, building a foundation for "banking as a service". In Europe, banks are opening to Payment Services Directive 2, which has an open API requirement, with more partnerships between banks and fintech to remove inefficiencies in bank processes. Globally there will be more increase open API and bank-fintech partnerships in 2016.

Change in boardroom structures: This kind of technology transformation needs a shift in thought process within the bank leadership. “Banks biggest failing is that they are run by bankers. Ninety-seven percent of bank chief executive officers (CEOs) are bankers and 77% of bank boardrooms have virtually nobody with technology experience. We will see a big shake-up in boardrooms this year as there needs to be more balance between financiers and technologist in decision-making," added Skinner.

Artificial intelligence (AI) and robotics: AI is expected to evolve from a buzzword into a critical capability that will help drive better outcomes for customer and increase efficiency for banks. Banks will increase the deployment of machine learning, AI and robotics – both through robotics processes automation (RPA) and chatbots, which is being actively explored by leading banks and likely to scale in 2017. These can enable engaged conversations with machines.

Internet of Things: The other area of interest will be the Internet of Things (IOT), which is yet to be actively explored and exploited by banks. “In building the internet of value to support IOT, when you have billions of devices making trillions of transactions of small value, it has not yet to be determined what network will support the underlying real time and cheap transaction system. One of the key themes this year will be how fintech companies will integrate their capabilities with concept of IOT,” commented Skinner.

“I think IoT will start in insurance because you need to insure your things. For example, Trov, an insuretech company, provides “pay as you use” in insurance, another insuarce company is talking about smart home security access. Eventually, the financial system will have to catch up with IoT to provide a transactional system to support and enable it. Right now, the concern is leaving that to players like Alipay and Applepay to manage the structure of aggregating small payments between things (and banks not being involved in it). I think it is a bit of blind sight and banks have not woken up to it,” he added.

Cybersecurity: Building cybersecurity in the digital and more so in the IOT environment will be challenging, which will demand multilayered security, enabled with analytics insights, biometrics and adaptive security measures. New authentication technology is expected to change the way customers transact with their banks. Banks are already exploring fingerprint, iris and palm vein recognition across digital services.

Blockchain: Among emerging technologies, distributed ledger technology has generated significant interest in the market, with venture capital investments already crossing $1 billion. And it will continue to witness new innovations. It is still in the early development phase, though we may see some commercial applications within the next couple of years. The mainstream adoption of blockchain is expected in the next five years.

Skinner believes that “blockchain is overhyped and not yet delivered. This year, we will see first delivery of real “use cases” where it needs to move out from laboratories to the real world.”

Partnership with fintech: With innovative technology that is focused on niche and unbanked segments, fintechs have started making a dent within the industry. Banks need to shift from legacy systems to digitally-enabled IT infrastructure – an open- and services-based architecture with application programming interface (API) banking. Incorporating ‘Banking as a service’ model, the banks can connect to open ecosystem of multiple partners each providing a unique service and speed the time to market.

Financial services institutions will have to cooperate, partner and co-exist with fintechs and learn to think and act like a fintech to develop a nimble and agile technological capability. Some of the leading banks have made direct investments into start-ups and are developing a fintech ecosystem through accelerator programs and “hackathons”. But are the banks doing enough to support fintechs?

“Some banks want to see themselves as leader like BBVA, DBS so they actively investin incubators, “hackathons”, and fintechs. But if you move beyond these names and the ‘marketing programmes’, there is actually very little happening. Lots of banks are watching the fintech market but not actively doing enough. That may now change because of the regulatory sandbox approach of bringing in companies that can take away inefficiencies,” Skinner explained.

While often represented as a competitor to banks, the development of fintech is having a rapid and pervasive impact to the banking sector, often more as partners.

“So much discussion is taking around ‘fintech replacing bank’ and yet I do not see a single fintech company that will ever replace a bank,” he said.

Categories:

Data & Analytics, Financial Technology, Internet Banking, Mobile Banking, Technology & OperationsKeywords:Technology, AI, Data, Robotics, API, IoT, Blockchain, Insuretech, Regtech. Fintech