Given that remittances are so lucrative in so many markets in Asia, and that new competitors are offering faster and cheaper services, banks will need to develop new models if they want to keep their customers.

January 31, 2019 | Richard Hartung- Global consumer remittances total more than $600 billion and generate $30 billion in fees, yet processes can be slow and expensive.

- Fintechs are developing safe, fast and cheaper ways to send money but are constrained by the financial system and payments infrastructure

- Banks are striving to compete better by adopting both blockchain and SWIFT gpi

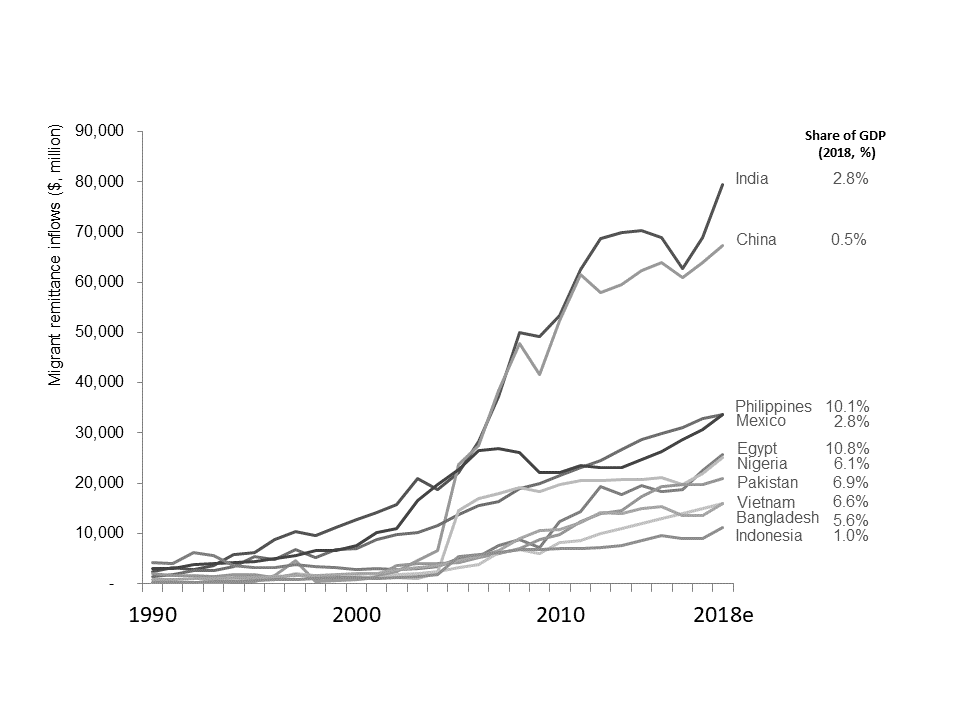

Total global remittances rose about 7% in 2017 to $613 billion, with about 76% of that amount going to low- and middle-income countries. Volume is expected to continue rising to close to $750 billion by 2020. About 400 million people in Asia are directly affected by remittances as a sender or receiver.

Asian countries remain the largest recipients of international remittances, and the funds are a major component of GDP in many countries

Figure 21: Top 10 migrant remittance receiving countries (2018)

Note: All numbers are in current (nominal,$),

Source: World Bank

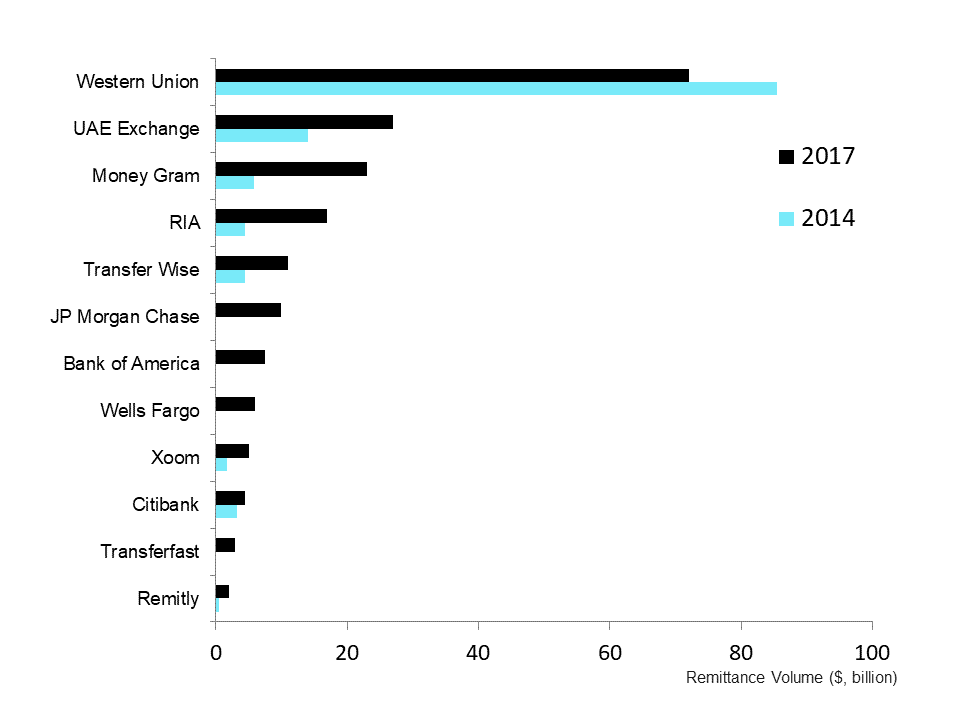

Given that remittance volumes and revenue are so huge, fintechs have plunged into the field. Indeed, the World Economic Forum (WEF) said that there are now more than 3,000 remittance service providers worldwide, creating greater competition and transparency. While Western Union is more than double the size of its largest money transfer operator(MTO) competitors, as shown in Figure 2, other competitors are growing rapidly.

While traditional players still dominate international remittances, newer companies such as TransferWise, RIA and Xoom have increasing market shares.

Figure 2: Remittances Volume ($, billion, 2014,2017)

Source: Asian Banker Research

A big growth area for MTOs has been mobile mon...

Categories:

Keywords:Remittances, Blockchain, SWIFT, Payment, Technology