While there is a dearth in bank’s funding and financial options for small and medium enterprises globally, new players are intercepting with their digital capabilities to provide lending to the growing sector. Recognising this gap and the entrance of new competition, HDFC launched SM@ Bank to provide SMEs’ with innovative and accessible financial services.

June 09, 2017 | Janine Marie Crisanto- SMEs are still struggling to access funds from banks due to several factors including the availability of credits

- Alternative lenders have emerged to take advantage of the opportunity to attract the underserved segment through technology

- In India, HDFC is striving to expand its SME business and compete digitally through SM@ Bank

Banks’ lending to small and medium enterprises (SMEs) has been constrained due to tighter regulation, stricter requirements and the perceived risk that accompanies the sector. According to the International Finance Corporation (IFC), there is an estimated credit gap for formal and informal micro, small and medium enterprises (MSMEs) at around $3.9 trillion globally. In line with this, alternative lenders in the form of peer-to-peer (P2P) lending platforms have emerged to fill in the credit gap in this space. These market disrupters leverage on technology and digital business models to make funding more accessible and

convenient – offering automated pricing, real-time analytics and more attractive and affordable loan offers. They have also slowly eliminated the need for clients to conduct banking face-to-face, instead introduced mobile and internet channels – leading to a new era of SME banking.

As such, banks are challenged to rethink their respective SME banking strategies and how they approach this segment in the digital age. Banks need to boost their digital services to develop analytics capabilities in risk profiling, improve cost-efficiency and boost competitiveness. If banks do not act and adapt quickly, they will risk a hold on SMEs which are a crucial growth engine in economies globally, particularly in developing countries.

In India, the Ministry of Micro, Small & Medium Enterprises Annual Report for 2015-16 estimate this sector to be comprised of about 51 million enterprises, which contributes to 37.5% of the country’s gross domestic product (GDP), 45% of the manufacturing output, 40% of the country’s exports employs over 117 million individuals.

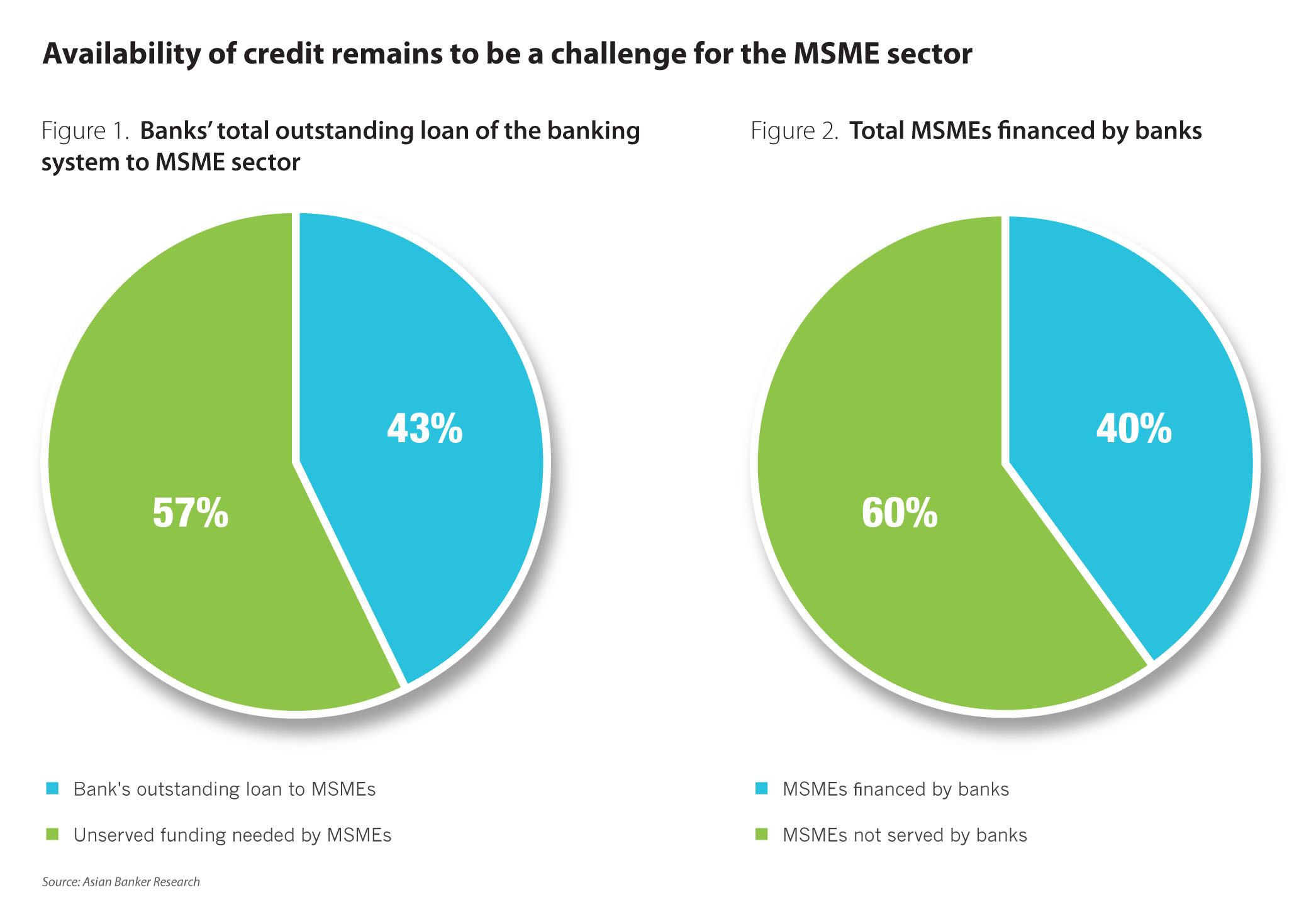

However, as important as they are to India’s economy, the financial access of these small businesses are hindered by factors such as the availability of timely credits and insufficiency of banking outlets to support the sector. The total outstanding loan of the banking system to India’s MSME sector stood at around $172 billion (INR11.1 trillion) in 20.6 million loan accounts as reported by The Reserve Bank of India (RBI). This is just about 40% of the total debt requirement of the 51 million enterprises (Figures 1 and 2).

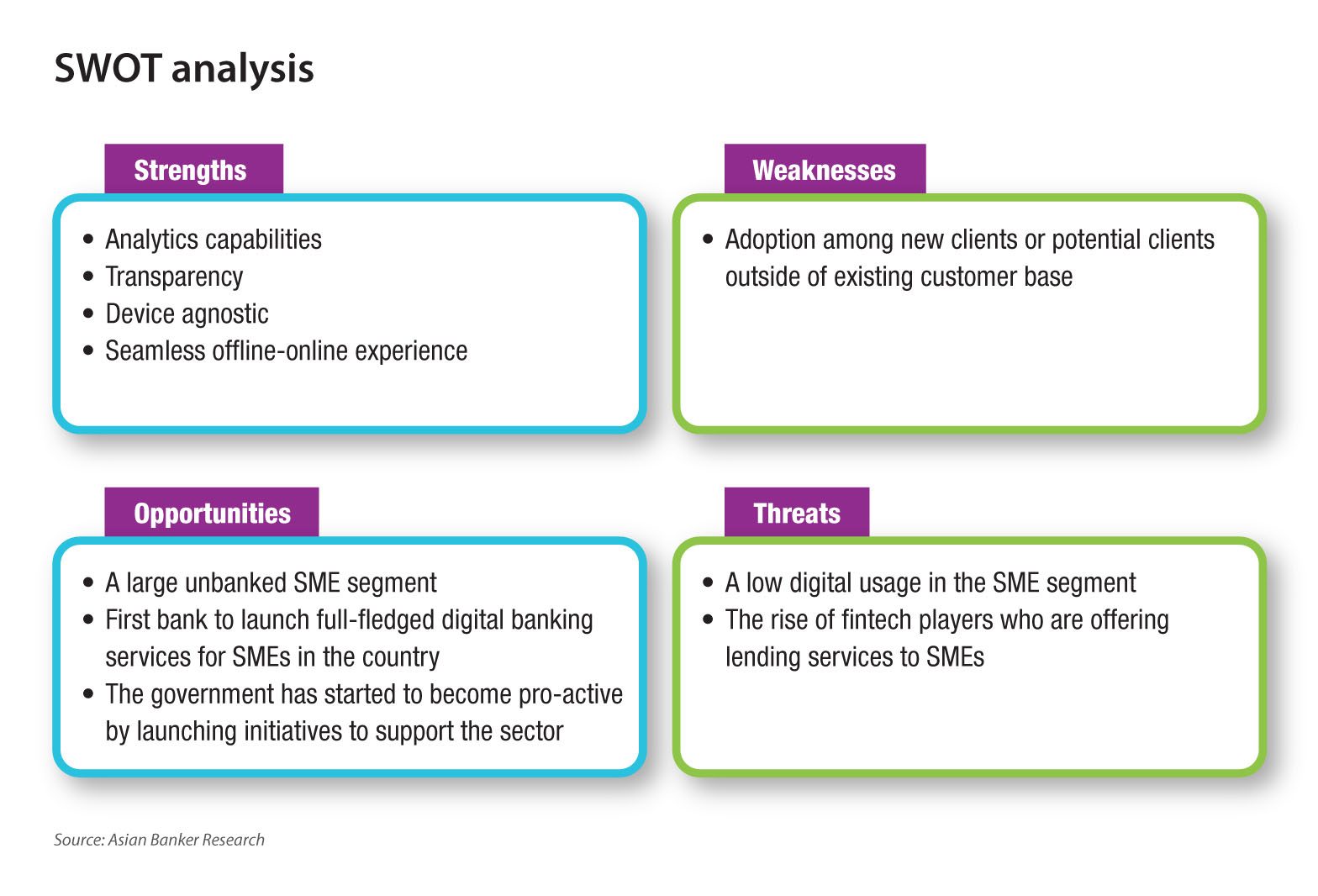

Recognising the dearth of financial options or SMEs as well as the need to innovate given economic factors, HDFC launched SM@ Bank, which claims to be India’s first full-fledged digital banking service solely for the underserved small businesses in the country. Aseem Dhru, HDFC’s Business Banking head, expressed “last year was a challenging but a defining one for the SME business. Demonetisation has seen a st eady shift towards digital transactions. This could well prove to be the catalyst that the industry needed or accelerated digitisation. What is more in such a scenario, the SM@ Bank has the potential to emerge as a game changer for the business."

SM@ Bank is the second leg of the "Bank Aapki Mutthi Mein" campaign that was launched for the bank’s retail customers in December 2014 to turn mobile phones into function as a bank branch. With this SM@ digital bank, HDFC aims to anchor on the benefits of digitisation to bring more value to its corporate clients – beginning with SMEs.

Redefining SME banking in India

HDFC wants to make a difference in two main aspects: loan application process and becoming a fully-integrated platform across front-end, middle-end and back-end.

According to Aseem Dhru, HDFC’s business banking head, loan application for SMEs can be cumbersome. The experience for SMEs in India is that applications goes into a black hole with no knowledge by the client of what is happening. Dhru expounds, “There used to be a huge dependency on brick and mortar network, as well as offline tracking and monitoring of loan applications. However, SMEs did not know how long to wait for banks’ decisions”.

In response, HDFC’s SM@ Bank was designed to cut the need for clients to walk into a branch or call a relationship manager (RM), which saves time and effort. Instead, the platform enables clients to access services on any device on a 24x7 basis. In terms of loan applications, clients just need to upload the required documents, and will receive in principle decisions within 24 hours. Once an agreement in principle has been made, an RM meets with the client, and will service them in tandem with the digital offering. HDFC does not claim to have a fully automated service, nevertheless, it has fostered a seamless online – offline experience where vital aspects are digitised.

In line with this, the platform offers one view of all their credit lines with the bank and the asset outstanding, as well as acquire letter of credit, bank guarantees, forward currency outward remittances, and pay and receive funds without the need for a cheque book. Businesses will also be able to upload stock statements and insurance financials online.

Transparency

The bank has also introduced QR code to its transactions to give its clients transparency and keep them informed on the status of every request. Moreover, because of its end-to-end automated workflow system, there is a trail of every request and transaction, as well as the movement of paperwork within the bank.

Risk identification

HDFC has also progressed from the traditional credit application to a digitised process where scores from four bureaus are accumulated. This is further supported by portfolio experience scores, scores built based on customer profile and risk appetite, and behavioural scorecard – enhancing the bank’s individual probability of default capabilities.

Data analytics

Dhru shared, “We don’t want to overfund the client. We are a little mor e subtle in using analytics in such a way that we are making the right offers to our client in when he requires it and ensuring that the fund is a vailable when the client needs it.” HDFC leverages on the account behaviour to predict client requirements and needs especially for already existing clients. SMEs can ask for seasonal or additional limits for sudden business requirements, and based on the anal ytics, the fund could be cr edited to their accounts almost instantly – cutting do wn turn-around time for preapprove loans. This addresses another challenge for SMEs – the a vailability of credit at a time when it is required by client. According to RBI, the availability of timely credit is essential for SMEs to survive cycle shocks.

In addition, data analytics also help the bank identify clients who are having trouble with repayments, and create tickets and reminders for them to have funds ready in their respective accounts in time for their renewal or expiry dates to ensure financial stabilit and avoid incurring debts.

Business impact

As of 2016, HDFC holds about a 7% market share of SMEs in India, which translates to about 100,000 businesses. With its new digital platform SM@ Bank, HDFC is expecting to grow this number by

30% annually.

Although the migration to SM@ Bank is mainly seen among its existing clients and not new ones, the bank has already converted almost 75% of its SME transaction digitally. In line with this, more than 60% of payments are happening on the digital facility.

The most popular function among its clients is the stock statement upload which is already at 90%. With SMEs growing between 8% and 15%, the bank also expects significant rise in its transactions and

revenue to every year.

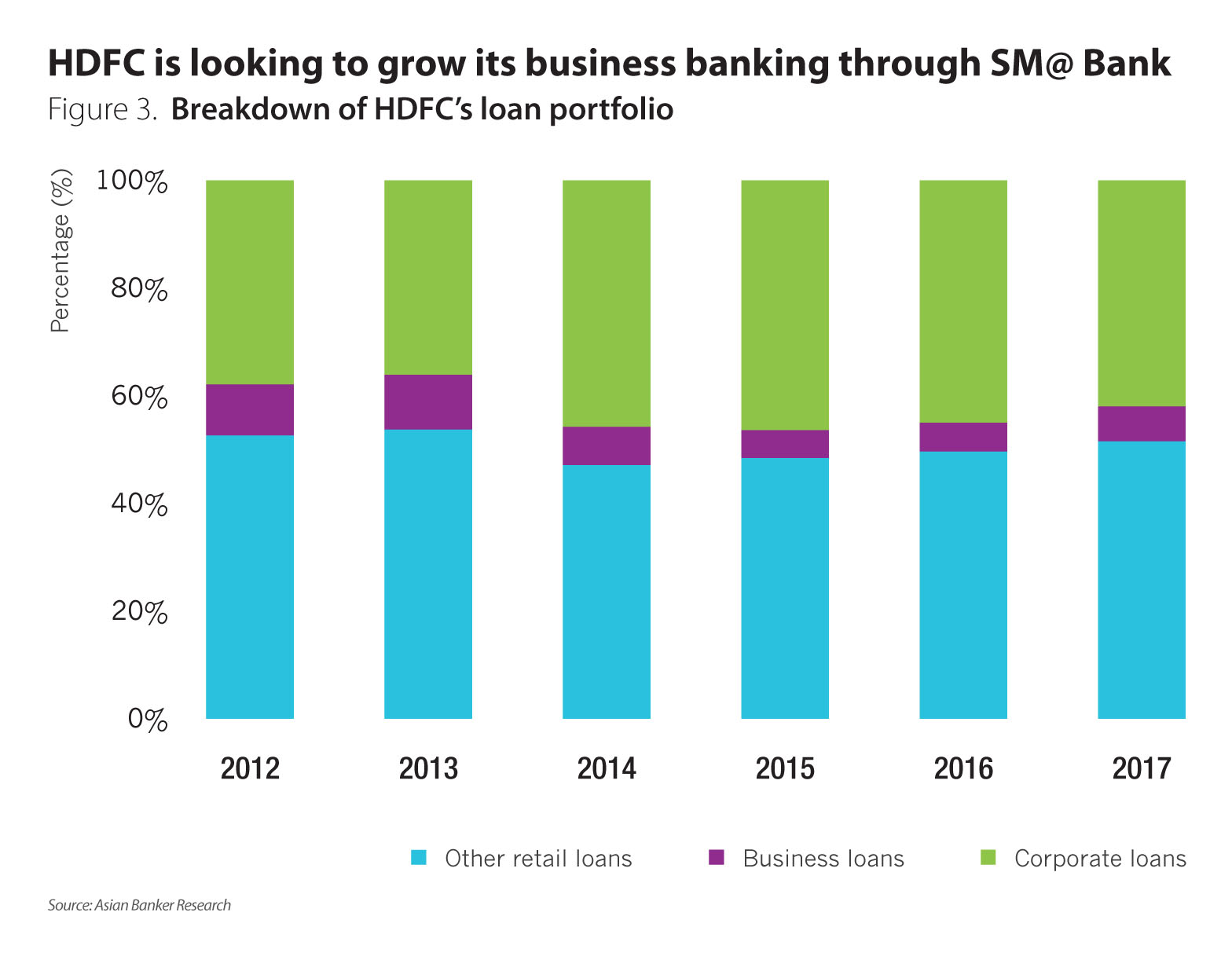

Moreover, HDFC’s business loans picked up in 2017 and its contribution to the bank’s total loan portfolio gained 110 basis points, after being stagnant the past two fiscal years (Figure 3).

The operational efficiency of the bank has also seen improvements. With SM@ Bank, HDFC is able to cater to more clients, and scale its SME business with lesser man power going forward. By automating and digitising important processes, the bank has also cut down the risk of mistakes and manual human error. In line with this, convenience and control the bank has provided its clients has contributed to customer delight.

Global comparison

ICICI Bank: In June 2016, it implemented an end-to-end automated workflow from lead generation to loan disbursement and aids monitoring for its SME business. The application is integrated with automated scoring models, rule engine, interface with various internal and external systems which ensures faster delivery to customer. The system also ensured data availability for monitoring and analytics, which is useful in product development.

Emirates UAE: The bank introduced hedging and treasury solutions for SME customers to mitigate risk in the volatile currency and commodity market. The objective was to increase penetration to activate customers for foreign exchange (forex) and trade, setup dedicated teams for trade finance and forex with the know-how and ability to provide need specific solutions. In addition, it migrated SME business customers from manual wages protection system (WPS) platform, to online channels and introduced smartPDF Telegraphic Transfer (TT) forms over manual form resulting to error reduction of smartPDF TT. It also boosted the activation of SME customers to the “smartBUSINESS” platform, a secure online transaction banking platforms for SMEs. Lastly, it introduced tablet banking and replaced touch tone-based interactive voice response (IVR) with speech- enabled IVR – the first in the country.

UOB Singapore: The bank launched a cloud-based “BizSmart” suite of integrated solutions to help SMEs with a number of their needs including ERP and supply chain management. UOB also offers its clients “BizMoney”, a programme that provides SMEs a collateral free loan at affordable rates; bundled with the “SME Working Capital Loan”, a government assistance funding scheme for SMEs administered by SPRING Singapore.

OCBC: The bank pioneered a new, streamlined process of on-boarding business owners who reincorporate with OCBC. OCBC is able to perform the end-to-end account opening process without a face to face meeting for less complex entity types such as sole proprietorships or single director private limited companies. However, sales staff still needs to call the customers to complete the application process. This results to a higher RM productivity - catering to more customers per day, less training needed and hence lower cost to serve.

In addition, customers that still prefer to visit a branch to open their account, OCBC implemented a mobile branch team to better service customers. The objective of this team is to improve resource allocation, increase cross-sell and offer better customer experience. Using data analytics, OCBC clustered branches based on their proximity and volume of accounts opened, then tagged a mobile branch officer to each cluster to open business accounts for walk-in customers.

The challenge now is expansion

Indeed, HDFC has initiated a digital proposition that is transforming the experience of SME banking in India. It has incor porated the benefits of technology to innovate not only a product or service, but the whole banking experience for this sector. It addresses issues such as inadequate branch network servicing the sector, as well as the availability of credit options for businesses.

However, the challenge remains in making this facility known and utilised given that the bank has seen slower adoption by new clients. It is impediment to rethink how to on-board more of the underserved SMEs in this digital age and build a more resilient SME ecosystem.

Categories:

Retail Banking, SME BankingKeywords:HDFC, SME, SM@ Bank, IFC, RBI, ICICI Bank, Emirates Bank, UOB Singapore, OCBC, MSME, SME Banking