HSBC’s first quarter 2015 earnings are better than expected but the bank has serious operational issues. Will a move to Asia bring it closer to its key income drivers?

June 19, 2015 | Colin SavageBattered by global and regional corporate governance scandals, money laundering, tax evasion and a sputtering franchise, analysts were not betting much on HSBC’s Q1 2015 results. But the bank proved them wrong. Its Q1 profit surpassed analysts’ estimates, driven by increased securities revenue and lower bad loans. Europe’s biggest bank achieved a $7.1 billion growth in pre-tax profits (Q1 2014: $6.8 billion) outperforming the average $5.8 billion estimate of five analysts (Bloomberg) by almost 20%. True, most business lines and key financial indicators declined based on full year 2014 financial results, but Q12015 year-on-year (YoY) performance showed improvement nevertheless, with a strong cost factor of 56%—lower than some of global peers such as Deutsche or JP Morgan. The big question is—what do they need to give up to protect the part of the business that is generating profit for the bank?

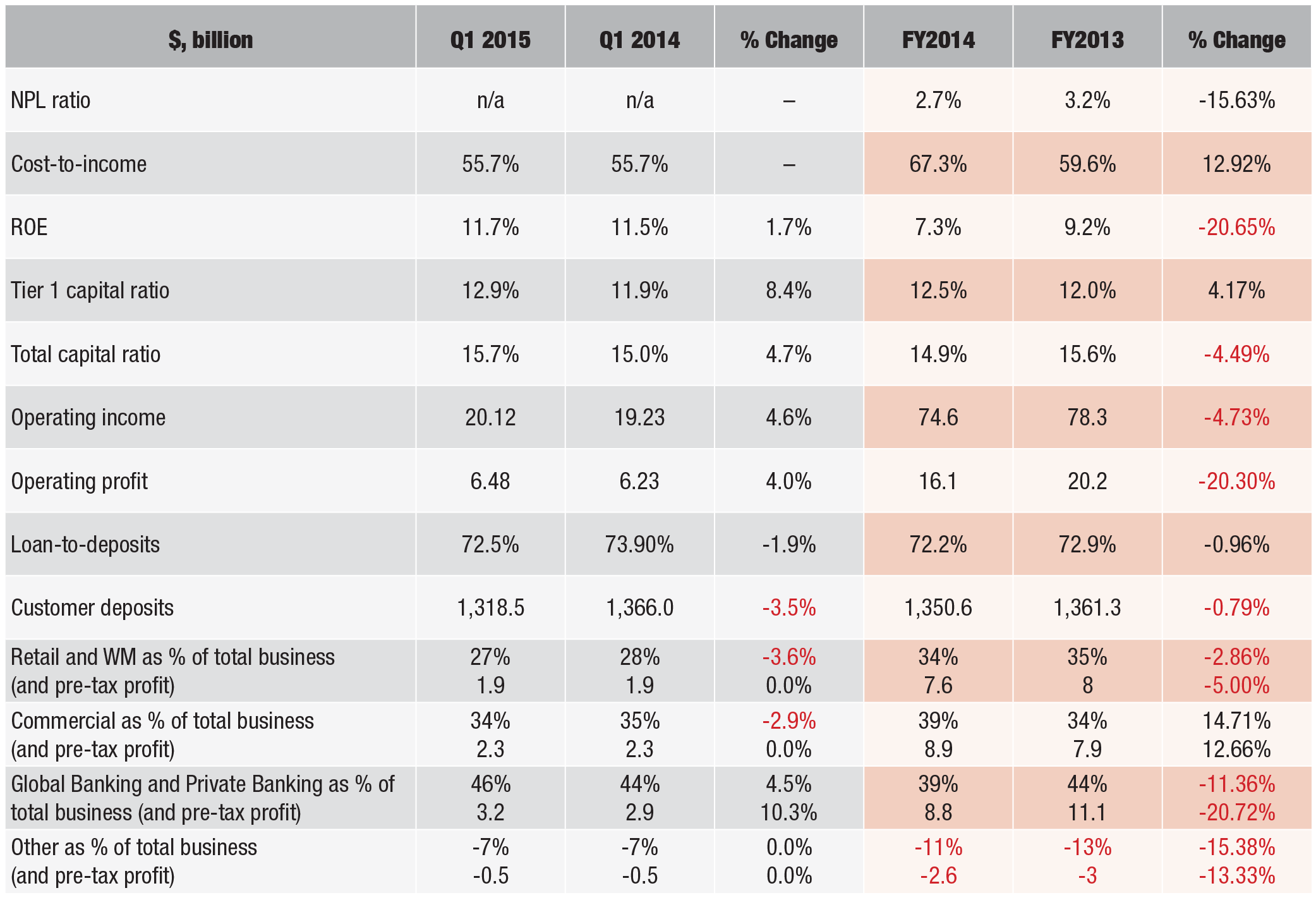

HSBC Holdings showed improvements across most financial indicators for Q12015 results

Fig. 1: Key Financial Indicators Q1 2015 YoY and FY 2014 YoY

Source: Asian Banker Research

*Note: Comprehensive financial figures are found at the end of this report.

We are concerned about the fact that investment banking at HSBC, as well as other global banks, is currently driving revenue. HSBC is a High Street bank to begin with and we see a lot of income from trading and investment banking contributing to its top line income. This hides a lot on the cost side of the business, and in our opinion hampers the ability to deal with some of the operational issues they have. Going forward, we believe HSBC has to deal with this mismatch between top-line growth from investment and cost from the operational commercial part sooner than later. The bank has been on a ...

Categories:

Asia Pacific, China, Databook, Hong Kong, Operational Risk, Retail Banking, Risk and Regulation, Capital Markets, Infrastructure FinanceKeywords:HSBC, Stuart Gulliver, Operating Profit Structure, Market Risk