Banks are expected to see continued growth in auto lending due to economic development but growth will be dampened by the rise of ride-sharing services.

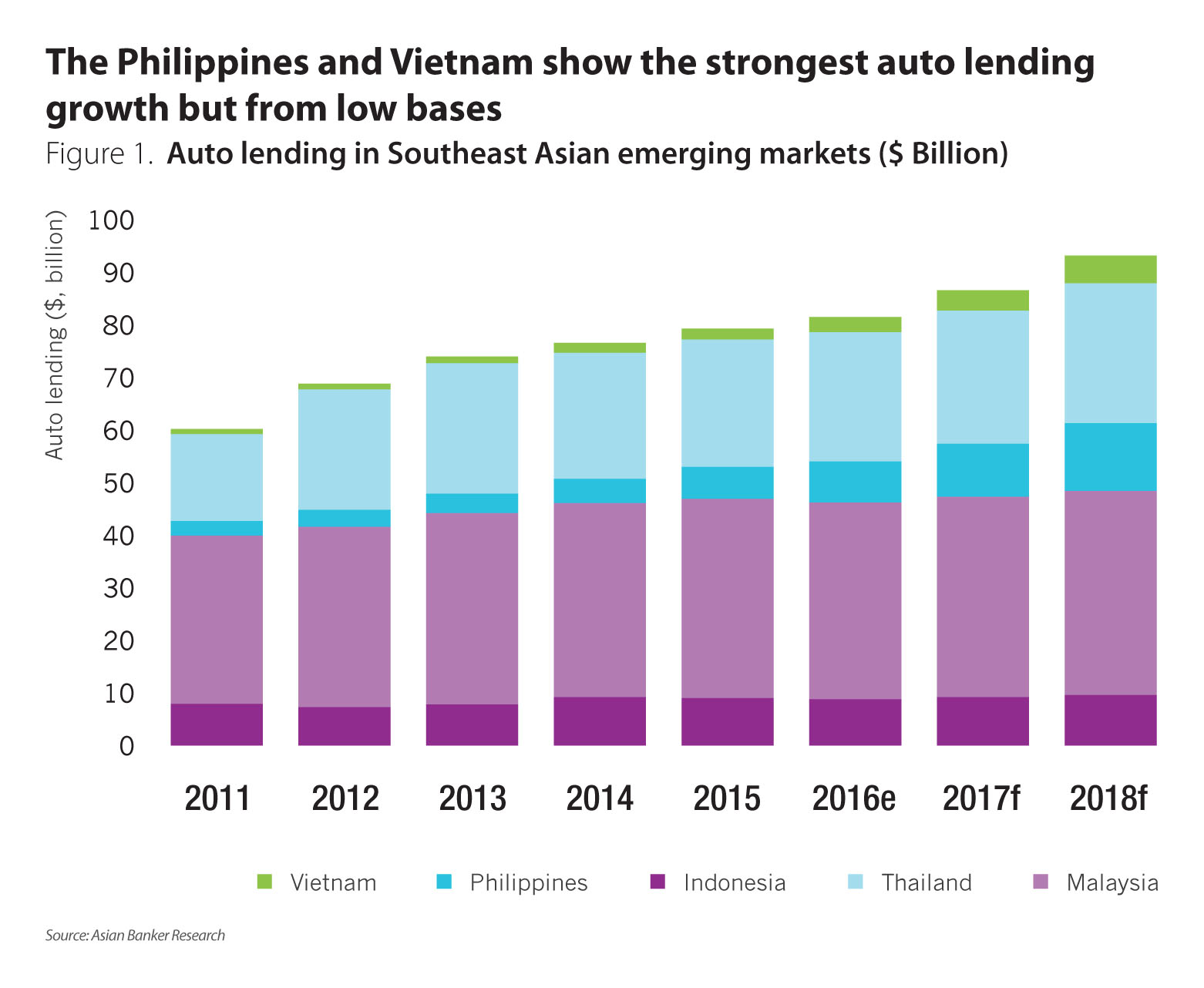

May 03, 2017 | Wendy Weng- Gross bank auto lending in five Southeast Asian countries is expected to reach $93 billion in 2018

- Favourable economic environments and increasing consumer purchasing power are some of the factors that will help sustain the growth of bank auto lending in Southeast Asia

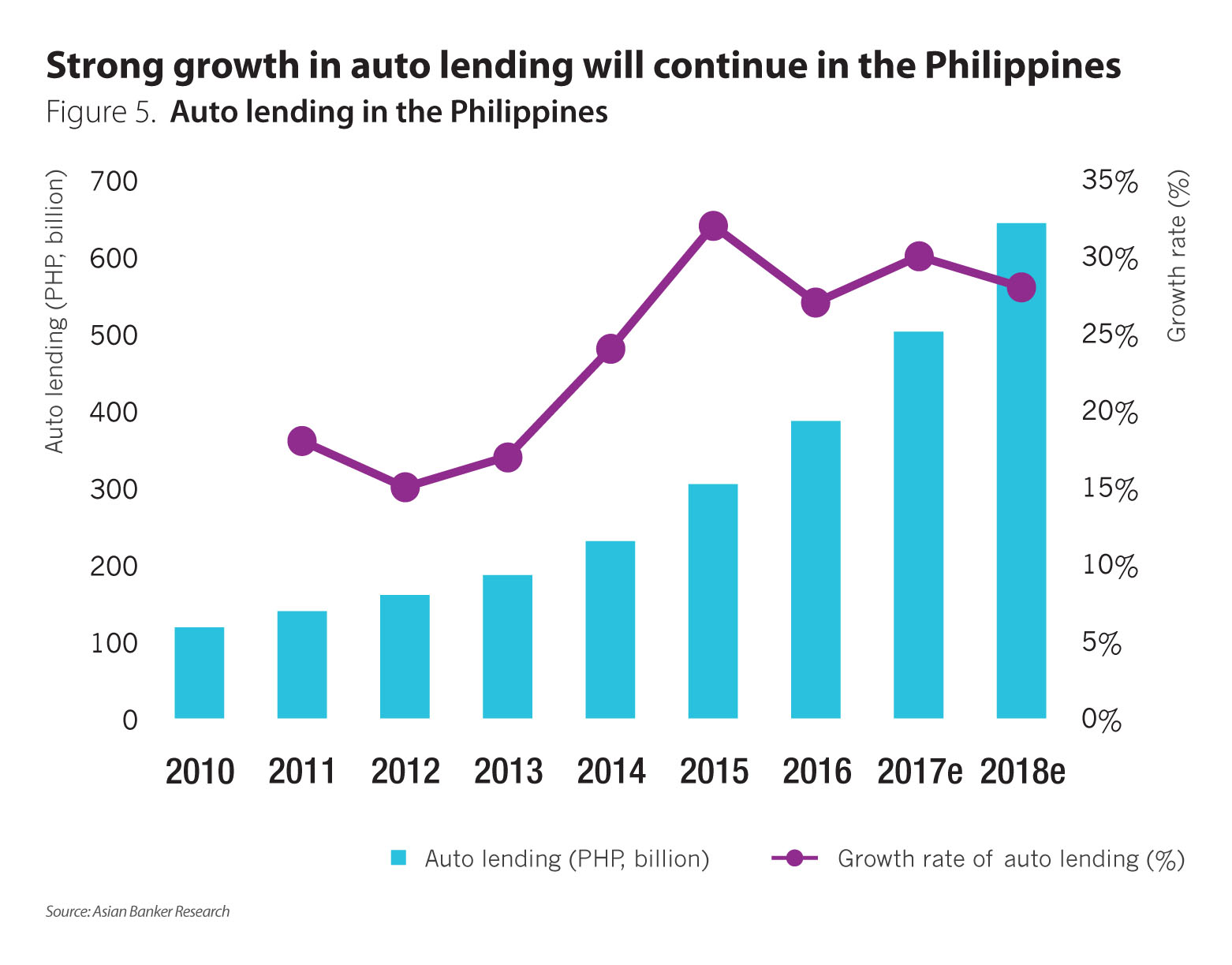

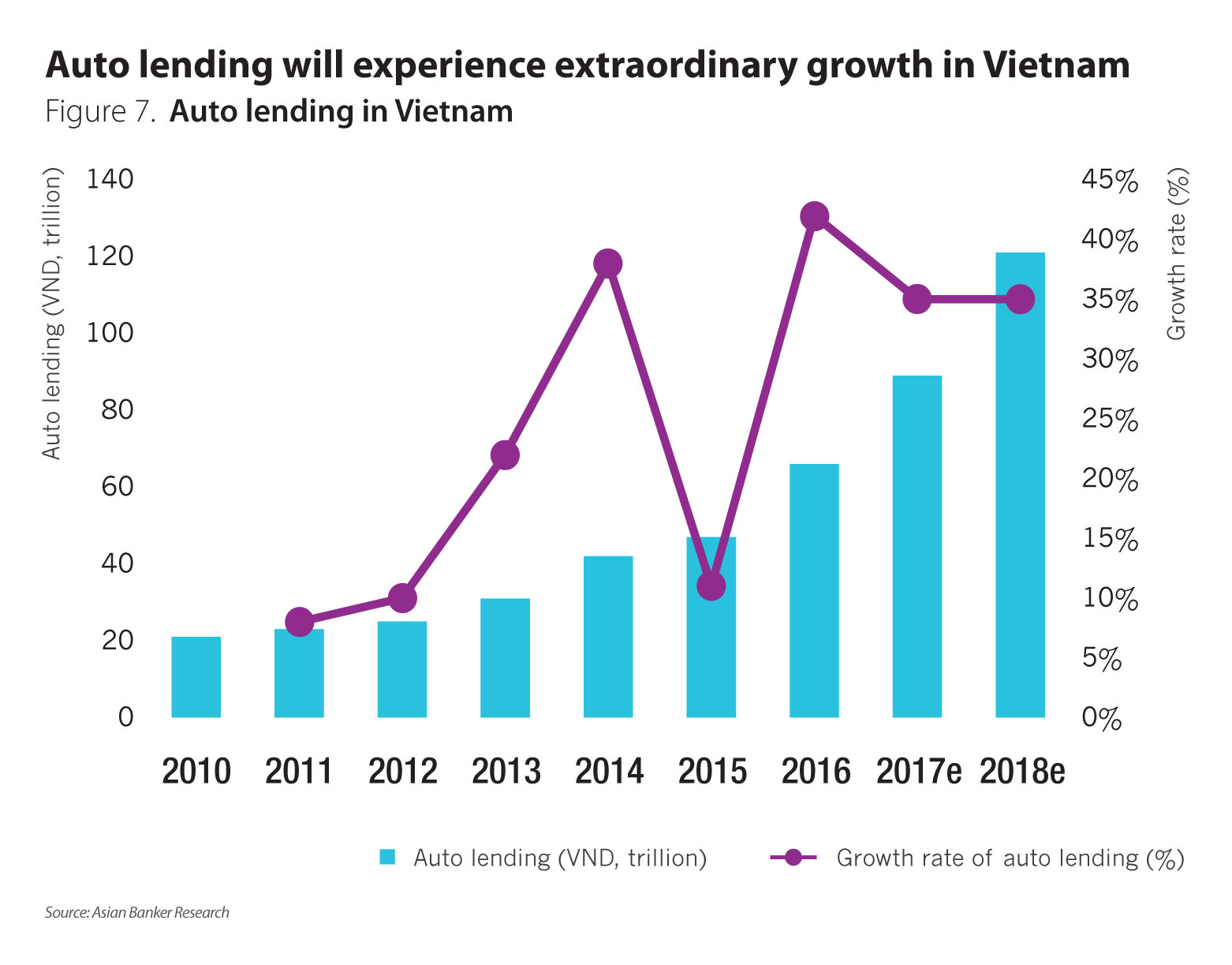

- The Philippines and Vietnam recorded faster auto lending growth than other Southeast Asian countries between 2011 and 2016

Between 2016 and 2018, bank auto lending to individual consumers is expected to expand at a compound annual growth rate (CAGR) of around 7% in five Southeast Asian emerging markets - Indonesia, Malaysia, the Philippines, Thailand and Vietnam.

Growth is expected to be sustained beyond 2018 due to factors such as favourable economic environments, increasing consumer purchasing power, relatively young populations with large and growing middle classes, low car ownership, and low auto finance penetration rates. This is despite the rise of ridesharing services and competition from non-bank auto financing companies.

In 2018, bank auto lending within these markets is estimated to be worth around $93 billion in total (Figure 1). However, auto lending in individual markets varied widely, with growth rates ranging between 2% and 24% per year from 2011 to 2016.

Banks in the Philippines and Vietnam, where car ownership is lowest, grew their auto lending significantly faster than other emerging markets over the same period, and this will continue in the next two years.

Malaysia has consistently accounted for the largest share of auto lending among these emerging markets, as it is the country with the highest rate of car ownership. However, auto lending in Malaysia is expected to grow by a mere 2% per year between 2016 and 2018, which will lead to a decrease in its share of gross auto lending from 46% in 2016 to 42% in 2018. On the contrary, considering the promising growth prospects in Vietnam, we expect Vietnam’s share will go up to 6% in 2018 from 4% in 2016. Likewise, the country’s share of gross auto lending will slightly decrease from 46% in 2016 to 42% in 2018. Vietnam made up around 4% of the gross auto lending in Southeast Asian emerging markets in 2016.

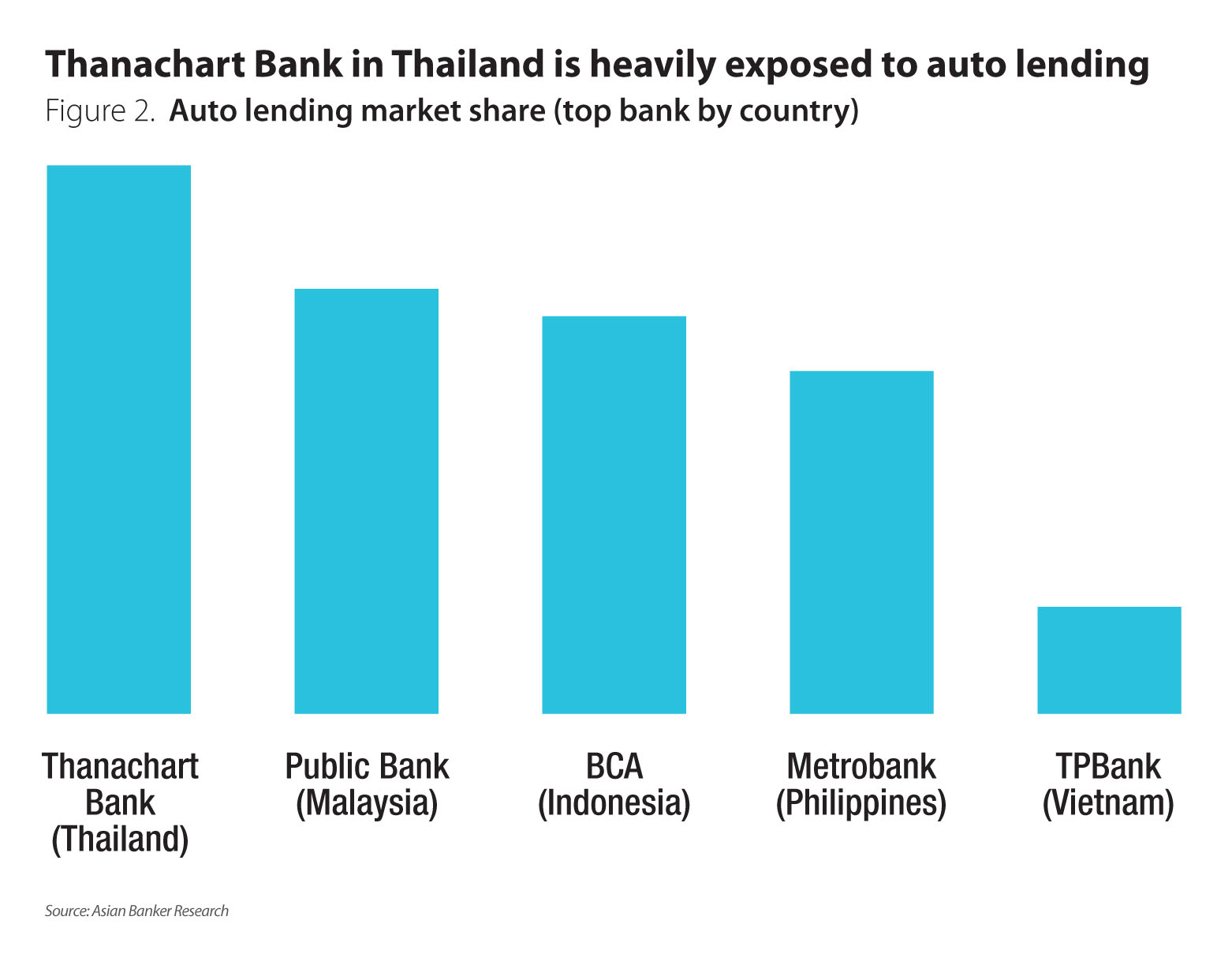

The used-car market has attracted more attention, and some banks are focusing more on used-car lending, such as Thanachart Bank in Thailand, the bank with the largest auto lending exposure among banks in these markets (Figure 2).

Indonesia

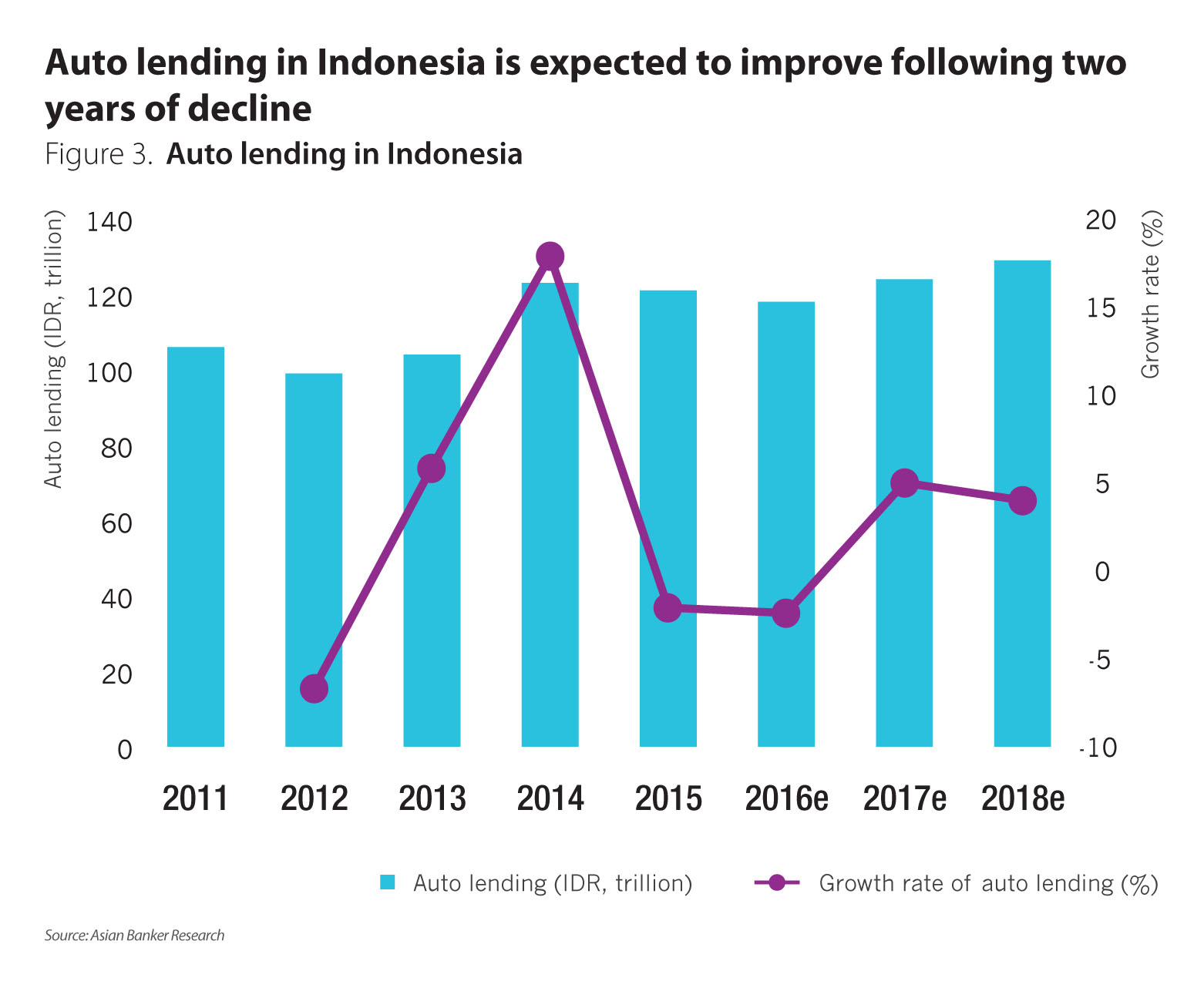

Auto lending in Indonesia fell by around 2% in both 2015 and 2016 (Figure 3). Consumer sentiment and purchasing power eroded amid weaker economic growth and slow recovery, with banks remaining cautious on lending in order to curb rising nonperforming loans. Auto lending was adversely affected by a new progressive tax on vehicles ownership imposed in Jakarta, which lifted the maximum tax rate to 10% from 4%. The decline can also be attributed in part to the increasing popularity of ride-sharing mobile application services such as Uber, Grab and Go-Jek, which has led to a faltering demand for private vehicles.

Auto lending is expected to rebound in 2017, buoyed by an improving economic outlook and lower interest rates. Indonesia’s central bank cut its benchmark interest rate by another 25 basis points to 4.75% in October 2016 to further stimulate credit growth.

Motorcycles remain the dominant transport mode in the country with around 6.2 million motorcycles sold in 2016, more than seven times the number of passenger vehicles sold. However, stronger demand for passenger vehicles is expected in the coming years, driven by a growing middle class and a low car ownership ratio in the country, along with continued urbanisation.

Malaysia

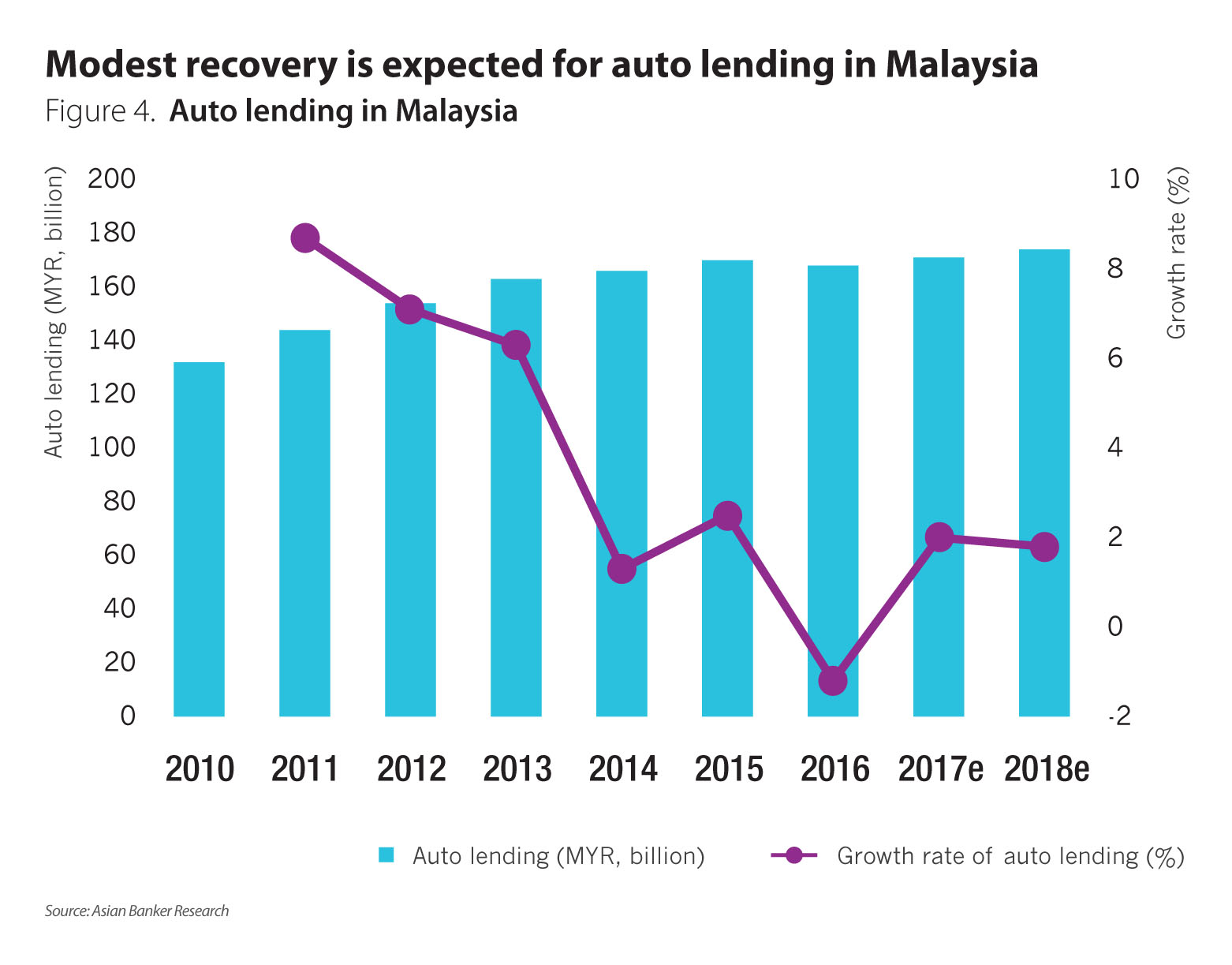

In Malaysia, auto lending grew at a moderate pace of 2.5% in 2015 but dropped by 1.2% in 2016, due to a combination of factors including the economic slowdown, ringgit devaluation, subdued consumer sentiments, stringent loan approvals, and a new goods and services tax (Figure 4). Consumers were prompted to purchase vehicles ahead of the implementation of the 6% goods and ser vices tax on 1st April 2015, which dampened demand in the following year. Meanwhile, demand for passenger cars was reduced as a result of enhancements to Malaysia’s public transportation system and the introduction of ride-sharing services.

Passenger vehicle sales plunged by approximately 13% in 2016, despite the launch of new and revamped models and aggressive sales promotions. Applications for passenger car loans went down by 1% in 2016, as consumers were hesitant to commit to purchases amid slowing economic growth and higher living costs. Furthermore, banks imposed tighter lending rules, which led to a 12% decline in passenger car loan approvals in 2016.

Economic growth in Malaysia is expected to pick up marginally in 2017. Banks will likely continue to apply strict lending approval rules due to the country’s high level of household debt. We expect auto lending to recover slightly in 2017 due to favourable demographics; Malaysia has a relatively young population.

The Philippines

Auto lending in the Philippines surged by 32% in 2015 and 28.5% year-on-year in the first nine months of 2016, owing to continued economic growth, a high inflow of remittances and a rising middle class (Figure 5). Affordable and flexible auto financing packages offered by banks and the low quality of mass-transport system are also key factors contributing to the growth of auto lending in the country. We expect continued impressive auto lending growth in the coming years.

Banks in the Philippines have promoted auto lending aggressively to seek a larger market share in this rapidly growing market. The easy access to vehicle financing options, attractive product offerings, and low interest rates and down payment requirements have made it easier and faster for consumers to purchase vehicles with repayment periods of up to six years on an escalating interest rate often provided by banks.

The country’s lack of an efficient mass transport system is motivating Filipino commuters to purchase their own vehicles to avoid the inconvenience and discomfort of public transport.

Thailand

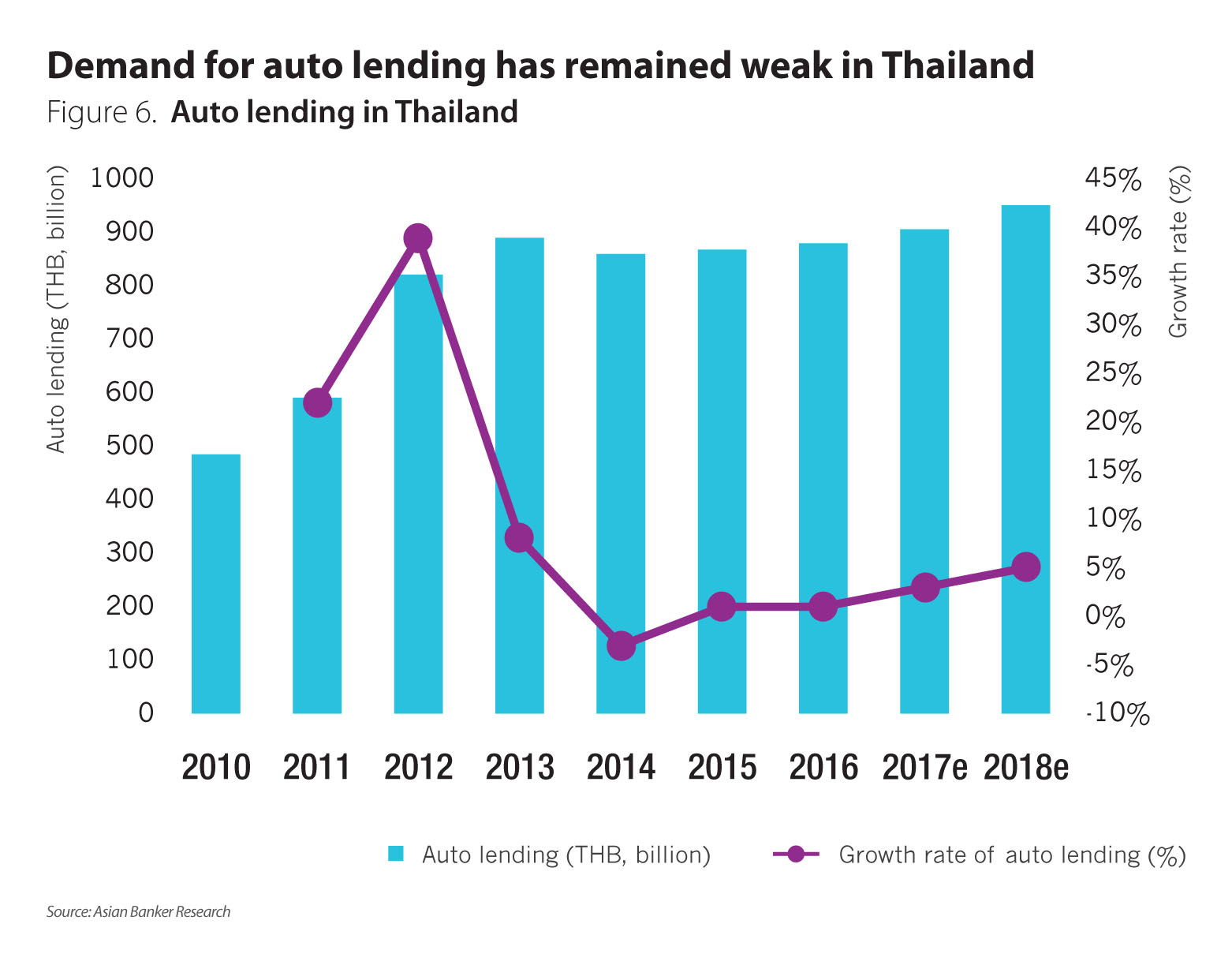

Auto lending in Thailand registered strong growth rates of 22% and 39% in 2011 and 2012 respectively, due to the boom in demand for vehicles created by the first-car subsidy scheme (Figure 6). The scheme, which refunded taxes for first-time car buyers, was introduced in September 2011 to boost the country’s automotive industry.

As buyers were required to retain ownership of the vehicle for at least five years, passenger vehicle sales have dropped each year since the scheme ended in December 2012. We expect auto lending in Thailand to recover modestly in 2017, boost ed by increased demand for vehicles and an improving economic environment. Passenger vehicle sales are expected to increase following the end of the lock-in period under the first-car subsidy scheme. However, the recovery will not be that strong in 2017, as the purchasing power of these first-time car buyers is weak and not e xpected to rebound sharply. With loan terms ranging from five to seven years, these buyers are unlikely to buy new cars in the next two years as they were largely low-income earners.

Furthermore, auto lending will be negatively affected by high household debt and the expected decline in economic activity following the one-year mourning period for King Bhumibol Adulyadej, who died in October 2016.

Vietnam

Vietnam has seen a significant increase in auto lending during the past few years, supported by rapid economic growth, improving purchasing power and a growing middle class (Figure 7). There has been a considerable boom in passenger vehicle sales, although the number of motorcycles sold was still far exceeded passenger vehicle sales which grew at a strong CAGR of 38% between 2012 and 2016.

We expect that car ownership will continue to increase in the coming years as the increasing demand for passenger vehicles is also driven by infrastructure improvements and lower car prices. In addition, more consumers are switching to cars from motorcycles, as worsening traffic congestion and air quality in Vietnam’s major cities make driving cars a preferred choice. Moreover, cars are considered as status symbols in the country.

Going forward, bank auto lending in Southeast Asian emerging markets will likely continue due to its massive potential despite adverse factors such as the rise of ride-sharing services.

Categories:

Auto-financing, Automobile Loans, Datafile, Industry Developments, Retail BankingKeywords:CAGR, Auto Lending