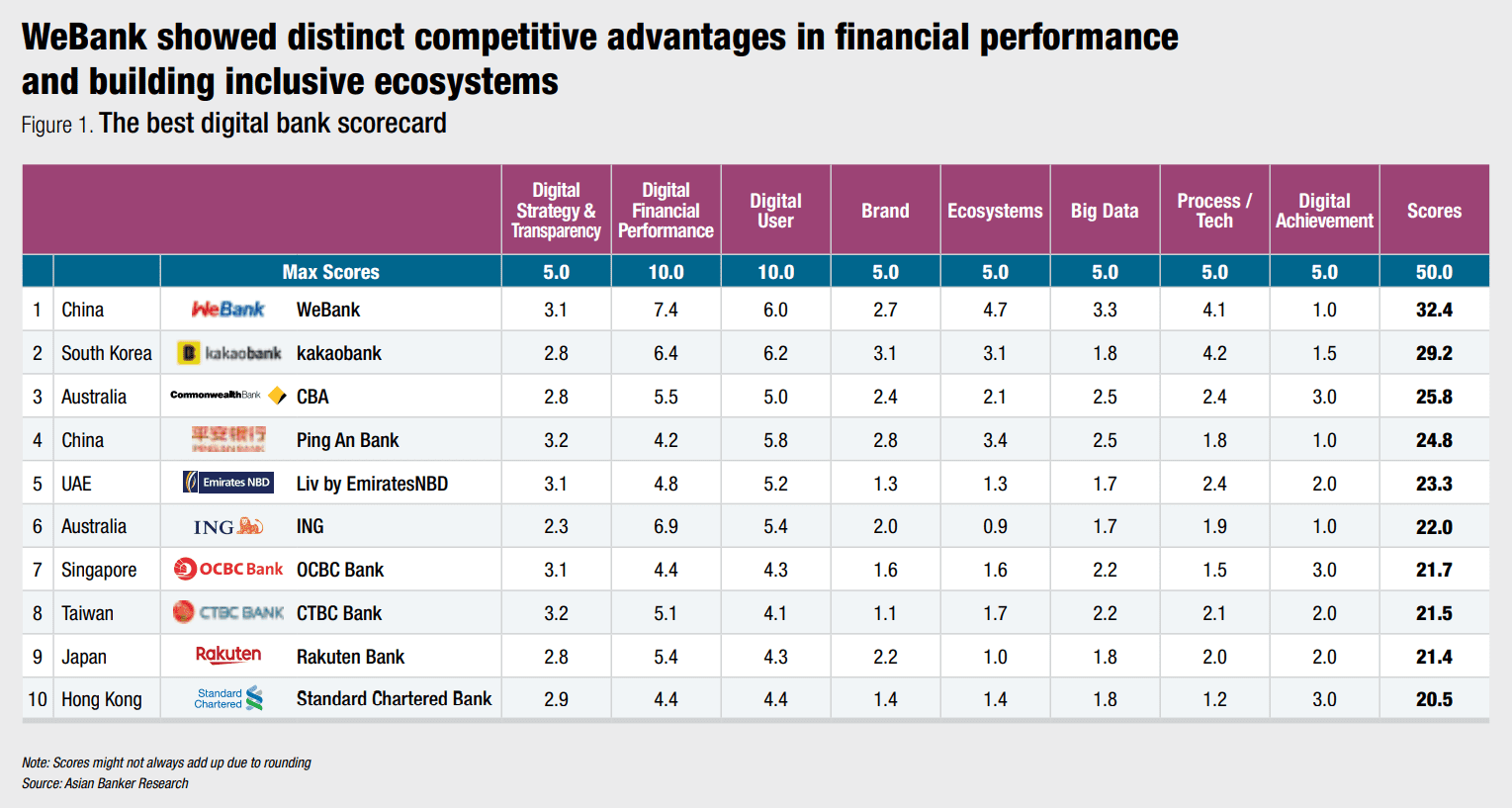

WeBank, the digital-only bank subsidiary of Tencent, has emerged as an industry leader due to its scale, profitability and innovation

October 21, 2020 | Janine Marie CrisantoThe digital banking race has been accelerating in line with a more supportive regulatory environment and sophistication of technology. Asian markets have gradually adopted digital banking licencing frameworks with an aim to boost market diversity and encourage healthy competition in the banking industry. Financial regulators in Australia, Hong Kong, China, India, Japan, South Korea, and Taiwan have all recently issued new licences. Singapore is still in the process of announcing the successful applicants. As new players enter the market, virtual banks need to exert more effort to scale and eventually achieve profitability.

This year, significant steps were taken to ensure that the Excellence awards programme remains the most rigorous, comprehensive and transparent of its kind for the financial services industry. The evaluation period was extended to take into consideration the disruptions caused by the COVID-19 pandemic and how banks are responding to it.

Among digital banks in Asia Pacific, WeBank emerged as a leading player in the region in terms of scale, profitability and execution of marketleading propositions.

Brand and digital users: dominance in digital banking space

Since its launch in 2014 as the first digital-only bank in China, WeBank has expanded its customer base to more than 200 million individual customers and 0.9 million small and micro businesses. The bank is estimated to add over three million users per month, while other players in the region are averaging around a hundred thousand.

Financial performance: net profit grew 60% in 2019

Profitability has been difficult to achieve for digital banks, given that players typically focus on expansion rather than profit by operating a no-fee model to compete with incumbent banks and build a customer base. On ave...

Categories:

Keywords: